LPA:136.8 Local Public Agency Land Acquisition: Difference between revisions

m Per RW, the Approved Fee Appraiser Roster (Roster of Approved Appraisers/Statewide Fee Appraiser List) updated |

m updated links to Acquisition Authority Request |

||

| (124 intermediate revisions by 6 users not shown) | |||

| Line 1: | Line 1: | ||

<div style="float: right; margin-right:5px; margin-top:7px; margin-bottom:7px; width:400px; background-color: #f5f5f5; padding: 0.3em; border: 1px solid #cccccc; text-align:left;"> | |||

'''<u><center>Forms</center></u>''' | |||

* [https://epg.modot.org/forms/general_files/DE/RW-LPA/Acquisition_Authority_Request(Form_136.8.1).docx Acquisition Authority Request (Form 136.8.1)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Adj%20of%20Value%20or%20Just%20Compensation%20Form%20136.8.2.docx Adjustment of Value or Just Compensation (Form 136.8.2)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Administrative%20Settlement%20Justification%20Form%20136.8.3.docx Administrative Settlement Justification (Form 136.8.3)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Appraisal%20Monitor%20Checklist%20Form%20136.8.4.docx Appraisal Monitor Checklist (Form 136.8.4)] | |||

* [https://epg.modot.org/forms/general_files/DE/RW-LPA/Appraisal_Review_and_Approval_of_Just_Compensation_Form_136.8.5.docx Appraisal Review (Form 136.8.5)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Assumptions%20and%20Limiting%20Conditions%20Form%20136.8.6.docx Assumptions and Limiting Conditions (Form 136.8.6)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Certificate%20of%20Appraiser%20Form%20136.8.7.docx Certificate of Appraiser (Form 136.8.7)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Clearance%20Certification%20Statement%20Form%20136.8.8.docx Clearance Certification Statement (Form 136.8.8)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Comparable%20Lease%20Form%20136.8.9.docx Comparable Lease (Form 136.8.9)] | |||

* [https://epg.modot.org/forms/general_files/DE/RW-LPA/Conditional_Clearance_Certification_Statement_Form_136.8.8.docx Conditional Clearance Certification Statement (Form 136.8.8)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Donation%20in%20Exchange%20for%20Construction%20Features%20Letter%20Form%20136.8.10.docx Donation in Exchange for Construction Features Letter (Form 136.8.10)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Final%20Vacancy%20Notice%20for%20Relocation%20Form%20136.8.11.docx Final Vacancy Notice for Relocation (Form 136.8.11)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Legal%20Justification%20for%20Settlement%20Form%20136.8.12.docx Legal Justification for Settlement (Form 136.8.12)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Legal%20Trial%20Report%20136.8.13.docx Legal Trial Report (Form 136.8.13)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/LPA%20Prorata.docx Local Public Agency Prorata Real Estate Tax Claim (Form 136.8.7.1.11)] | |||

* [[media:236 RW Leaflet.doc|LPA Right of Way Acquisition Brochure]] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/LPA%20Negotiator%20Services%20Agreement%20Form%20136.8.14.docx LPA Negotiator Services Agreement (Form 136.8.14)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Negotiator's%20Report%20Form%20136.8.15.docx Negotiator's Report (Form 136.8.15)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Nonresidential%20Sale%20Form%20136.8.16.docx Nonresidential Sale (Form 136.8.16)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Parcel%20File%20Checklist%20Form%20136.8.17.docx Parcel File Checklist (Form 136.8.17)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Plan%20Review%20Checklist%20Form%20136.8.18.docx Plan Review Checklist (Form 136.8.18)] | |||

* [[media:Letter of Certification Preliminary Plans Approval Form 136.8.docx|Preliminary Plans Approval Form]] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Privately%20Donated%20Land%20as%20Credit%20to%20Matching%20Share%20of%20Project%20Costs%20Form%20136.8.19.docx Privately Donated Land as Credit to Matching Share of Project Costs (Soft Match), Form 136.8.19] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Project%20Acquisition%20Monitor%20Checklist%20Form%20136.8.20.docx Project Acquisition Monitor Checklist (Form 136.8.20)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Proposal%20for%20Appraisal%20Work%20Form%20136.8.21.docx Proposal for Appraisal Work (Form 136.8.21)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Relocation%20Monitor%20Checklist%20Form%20136.8.22.docx Relocation Monitor Checklist (Form 136.8.22)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Residential%20Sale%20Form%20136.8.23.docx Residential Sale (Form 136.8.23)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Review%20Appraiser%20Contract%20Form%20136.8.24.docx Review Appraiser Contract (Form 136.8.24)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Right%20of%20Way%20Acquisition%20Schedule%20Form%20136.8.2.2.docx Right of Way Acquisition Schedule (Form 136.8.2.2)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Right%20of%20Way%20Acquisition%20Scehdule%20Instructions%20Form%20136.8.2.2.A.docx Right of Way Acquisition Schedule Instructions (Form 136.8.2.2.A)] | |||

* [[media:136.8.8a.docx|Right of Way Required - Personal Property Moved - Occupied Improvements Acquired (Form 136.8.8a)]] | |||

* [https://epg.modot.org/forms/RW/Chapter%206_Appraisal%20and%20Appraisal%20Review/Roster%20of%20Approved%20Contract%20Appraisers.pdf Roster of Approved Contract Appraisers] | |||

* [https://www.modot.org/media/42292 Roster of Approved LPA Negotiators] | |||

* [https://epg.modot.org/forms/RW/Chapter%207_Negotiation/Roster%20of%20Approved%20Contract%20Negotiators.pdf Roster of Approved MoDOT Contract Negotiators] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Sample%20Donation%20Letter%20and%20Waiver%20of%20Appraisal%20Form%20136.8.25.docx Sample Donation Letter and Waiver of Appraisal, Form 136.8.25] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Sample%20Letter%20Offer%20Pyment%20Estimate%20Form%20136.8.26.docx Sample Letter Offer (Payment Estimate), Form 136.8.26] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Sample%20Letter%20Offer%20Value%20Finding%20or%20Standard%20Formt%20Appraisal%20Form%20136.8.27.docx Sample Letter Offer (Value Finding or Standard Format Appraisal), Form 136.8.27] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Scope%20of%20Assignment%20Form%20136.8.28.docx Scope of Assignment (Form 136.8.28)] | |||

* [https://epg.modot.org/forms/general_files/DE/RW-LPA/Standard_Appraisal_Form_136.8.29.docx Standard Appraisal Format (Form 136.8.29)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Summary%20of%20HB%201944%20Form%20136.8.30.docx Summary of HB 1944 (Form 136.8.30)]. | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/Summary%20Value%20of%20Tenant%20Interests%20Form%20136.8.31.docx Summary Value of Tenant Interests (Form 136.8.31)] | |||

* [https://epg.modot.org/forms/general_files/DE/RW-LPA/Uniform_Residential_Appraisal_Format_(URAR)_Form_136.8.32.docx Uniform Residential Appraisal Report (URAR), Form 136.8.32] | |||

* [https://epg.modot.org/forms/general_files/DE/RW-LPA/Value_Finding_Appraisal_Format_136.8.33.docx Value Finding Appraisal Format (Form 136.8.33)] | |||

* [https://epg.modot.org/forms/general_files/DE/RW-LPA/Waiver_Valuation_Payment_Estimate_Form_136.8.34.docx Waiver Valuation - Payment Estimate (Form 136.8.34)] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/60%20Day%20Notice%20of%20Owners%20Rights%20Form%20136.8.35.docx 60-Day Notice of Owners Rights (Form 136.8.35)] | |||

'''<u><center>"How To" PowerPoint Tutorials</center></u>''' | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/How%20to%20Request%20RW%20Acquisition%20Authority.pptx How to Request Right of Way Acquisition Authority] | |||

* [https://epg.modot.org/forms/RW/LPA%20Links/How%20to%20Complete%20Right%20of%20Way%20Clearance%20Certification%20Request%205%20year%20rule.pptx How to Complete Right of Way Clearance Certification Request (5-Year Rule)] | |||

'''<u><center>"Federal-Aid Essential Videos</center></u>''' | |||

* [http://www.fhwa.dot.gov/federal-aidessentials/catmod.cfm?category=develop Project Development] | |||

* [http://www.fhwa.dot.gov/federal-aidessentials/catmod.cfm?category=rightofw Right of Way] | |||

</div> | |||

= | =136.8.1 General= | ||

== | ==136.8.1.1 Introduction== | ||

The acquisition of private property needed in connection with all Federally funded projects is governed by the '''Uniform Relocation Assistance and Real Property Acquisition Policies Act of 1970, as amended''' (commonly referred to as the Uniform Act) and requirements of | The acquisition of private property needed in connection with all Federally funded projects is governed by the '''Uniform Relocation Assistance and Real Property Acquisition Policies Act of 1970, as amended''' (commonly referred to as the Uniform Act) and requirements of state laws as well as any applicable local ordinances. The implementing regulations for the Uniform Act are found in [http://www.fhwa.dot.gov/realestate/ua/index.htm 49 Code of Federal Regulations (CFR) Part 24 and 23 CFR Part 710]. District offices of the Missouri Department of Transportation (MoDOT) can provide copies of the appropriate codes and regulations, upon request. | ||

Federal funding of any phase of a project necessitates that | Federal funding of any phase of a project necessitates that federal requirements be met in all other phases of the project, as well as the acquisition of property and relocation activities to clear the right of way for construction. Noncompliance with federal law can result in ineligibility for reimbursement for project costs in design, land acquisition, or construction. | ||

Such projects might include roads, bike/walking paths, block grants, and enhancements, etc. Guidelines and requirements for the acquisition of land for [[:Category:122 Aviation|airports]] and airport expansion projects, are set out in an Aviation land acquisition manual, available from the Multimodal Operations Division of MoDOT. | Such projects might include roads, bike/walking paths, block grants, and enhancements, etc. Guidelines and requirements for the acquisition of land for [[:Category:122 Aviation|airports]] and airport expansion projects, are set out in an Aviation land acquisition manual, available from the Multimodal Operations Division of MoDOT. | ||

Local Public Agencies (LPAs) that must comply with the provisions contained in this article are cities, counties, and any agency acquiring private property or property rights, who have not developed their own manuals or guidelines for the acquisition of private property or property rights. Manuals and procedural guidelines developed by a | Local Public Agencies (LPAs) that must comply with the provisions contained in this article are cities, counties, and any agency acquiring private property or property rights, who have not developed their own manuals or guidelines for the acquisition of private property or property rights. Manuals and procedural guidelines developed by a LPA require the approval of the Federal Highway Administration. | ||

This | This article is designed to assist LPAs in complying with applicable federal and state requirements. It is intended for use on small or uncomplicated projects where most of the needed property may be donated, damages to remaining property are minor and no one will be displaced from their homes, farms or businesses. | ||

If a project has more complex acquisitions than described above, or requires the relocation of property owners or personal property, | If a project has more complex acquisitions than described above, or requires the relocation of property owners or personal property, contact the Right of Way office in a MoDOT [http://www.modot.mo.gov/ district office] for other applicable instructions. | ||

== | ==136.8.1.2 State Responsibility== | ||

MoDOT has the responsibility to | MoDOT has the responsibility to ensure that all realty rights needed in connection with a Federal-aid project is acquired in accordance with the Uniform Relocation Act. As outlined in the program agreement between MoDOT and the LPA, MoDOT will monitor LPA acquisition staff and fee services in the acquisition of realty rights. | ||

If an LPA is not adequately staffed to perform these services, the use of fee services in the acquisition process is permitted. | The person identified as the LPA ROW Negotiator is required to complete the LPA ROW Negotiator training and must be listed on the [https://www.modot.org/sites/default/files/documents/Official%20LPA%20Basic%20Training%20Roster%20Master_109.pdf LPA Basic Training and ROW Negotiator Roster]. The duration of the approval on the LPA Basic Training and ROW Negotiator Roster is two years. | ||

If an LPA is not adequately staffed to perform these services or has not completed the [https://www.modot.org/lpa-basic-training-class-link LPA ROW Negotiator training] within the last two years, the use of fee services in the acquisition process is permitted. The fee negotiator will also be required to complete the LPA ROW Negotiator training and be listed on the LPA Basic Training and ROW Negotiator Roster. Use of fee services for land acquisition activities is covered in [[:LPA:136.8_Local_Public_Agency_Land_Acquisition#136.8.11_Right_of_Way_Services_Through_Contract|EPG 136.8.11]]. Additionally, appraisers and review appraisers must be listed on the approved appraisal roster when reports require value finding and standard appraisal formats per [[LPA:136.8_Local_Public_Agency_Land_Acquisition#136.8.6.1.3_Staff_and_Fee_Appraisal_Review_Activity_and_Personnel_Approval_by_MoDOT|EPG 136.8.6.1.3 Staff and Fee Appraisal Review Activity and Personnel Approval by MoDOT]]. | |||

MoDOT will monitor real property acquisition and relocation assistance activities conducted by, or on the behalf of, an LPA to determine that these activities are conducted in accordance with provisions of state and federal laws and directives. | MoDOT will monitor real property acquisition and relocation assistance activities conducted by, or on the behalf of, an LPA to determine that these activities are conducted in accordance with provisions of state and federal laws and directives. | ||

== | ==136.8.1.3 Local Public Agency’s Responsibility== | ||

The LPA is responsible for acquisition of all necessary property to permit project construction. This includes right of way, permanent easements (i.e. slopes, drainage, etc.), temporary easements (i.e. construction, [[Borrow and | The LPA is responsible for acquisition of all necessary property to permit project construction. This includes right of way, permanent easements (i.e. slopes, drainage, etc.), temporary easements (i.e. construction, [[127.22 Off-Site Borrow, Spoil, and Staging Areas|borrow]], etc.), licenses (i.e. rights of entry, work permits, grade separation agreements, etc.) or any other agreements for the entering on or use of land or property rights for construction purposes. | ||

The LPA must comply with all applicable requirements if | The LPA must comply with all applicable requirements if federal funds are used in any phase of the project. | ||

'''A. Nondiscrimination''' | '''A. Nondiscrimination''' | ||

LPAs shall comply with all | LPAs shall comply with all state and federal statutes relating to nondiscrimination, including but not limited to Title VI and Title VII of the Civil Rights Act of 1964, as amended (42 USC 2000 d, e), as well as any applicable titles of the Americans with Disabilities Act (ADA). LPAs shall not discriminate on grounds of the race, color, religion, creed, sex, disability, national origin, age or ancestry of any individual. | ||

'''B. [[236.7 Negotiation#236.7.7 1099-S Reporting of Acquisitions|1099 Reporting]]''' | '''B. [[236.7 Negotiation#236.7.7 1099-S Reporting of Acquisitions|1099 Reporting]]''' | ||

| Line 116: | Line 96: | ||

Typically, closing agents are required to do the 1099 reporting for all transactions over $600. The LPA would be responsible for this reporting if no closing agent is used, or if compensation is paid through the court system. | Typically, closing agents are required to do the 1099 reporting for all transactions over $600. The LPA would be responsible for this reporting if no closing agent is used, or if compensation is paid through the court system. | ||

== | ==136.8.1.4 MoDOT Right of Way Procedures== | ||

MoDOT has developed [[:Category:236 Right of Way| | MoDOT has developed [[:Category:236 Right of Way|EPG 236 Right of Way]] that governs its activities relating to right of way acquisition. These procedures define functions, operational procedures and guidance necessary to be eligible for federal funds participation in right of way. Local agencies will be required to follow MoDOT procedures or those contained in this article, unless the agency develops their own written policies and procedures for compliance with the Uniform Act and the [http://www.fhwa.dot.gov/realestate/ua/index.htm Code of Federal Regulations 49 CFR Part 24]. In condemnation, the agency must also fulfill the requirements of [https://revisor.mo.gov/main/OneSection.aspx?section=523 RSMo 523]. These written policies and procedures would be subject to review and acceptance by MoDOT and Federal Highway Administration (FHWA) prior to utilization on a Federal-aid project. | ||

== | ==136.8.1.5 Local Public Agency Right of Way Acquisition Brochure== | ||

An [[media:236 RW Leaflet.doc|LPA Right of Way Acquisition Brochure]] or [http://www.fhwa.dot.gov/realestate/realprop/index.html FHWA brochure] specifically designed for LPA use is available in preprinted form through MoDOT district offices. The right of way acquisition brochure should be made available to all affected property owners on a project at the earliest opportunity (at public hearings, during engineering surveys, first contacts for acquisition of property) to indicate the agency's interest in acquiring the real property and to advise the owner of the acquisition process, and basic protection under the law. The brochure satisfies certain requirements when public hearings are necessary, as well as notification requirements before or upon initiation of negotiations with owners. | |||

LPAs may develop and use their own brochures with prior MoDOT approval. | LPAs may develop and use their own brochures with prior MoDOT approval. | ||

A brochure identifying relocation assistance eligibility and benefits is also available from the MoDOT district office for those parties or businesses that are displaced or must move personal property from the proposed right of way. | A brochure identifying relocation assistance eligibility and benefits is also available from the MoDOT district office for those parties or businesses that are displaced or must move personal property from the proposed right of way. Contact your district RW office for the most recent relocation assistance brochures available for residential and business displacements. | ||

==136.8.1.6 Local Public Agency - Right of Way and Easement Acquisition== | |||

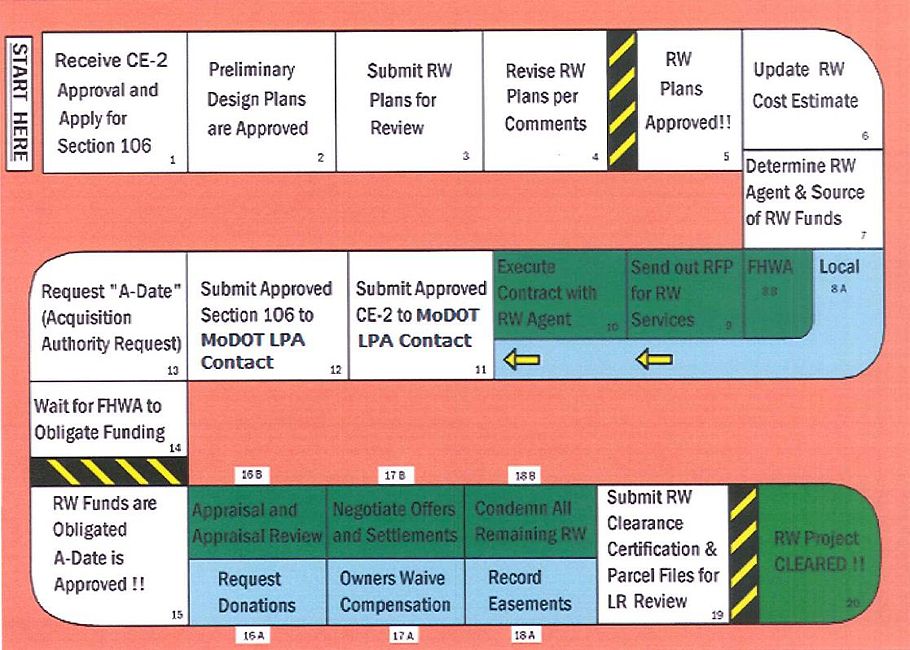

'''General Summary of the Right of Way Process''' | |||

The Local Public Agency (LPA) has been awarded a federal-aid project on the Transportation Implementation Program (TIP). The Reasonable Progress Policy and the schedule set by the LPA fixes time lines to be met. With right of way acquisition involved in your project, you must plan to continue the design and acquire right of way simultaneously. Coordination and planning is key to the success of the LPA. To this end, MoDOT has prepared a simple flow chart to help you visualize and plan the acquisition process for your LPA project. | |||

[[image:236.18.1.6 Flow Chart.jpg|910px|center|thumb|<center>'''RW Flow Chart for the LPA'''</center> | |||

<center> An [[media:236.18.1.6 Flow Chart.pdf|easily printable version]] of the chart is also available.</center>]] | |||

The goal is to acquire right of way AND certify it clear; at the same time the final Plans Specifications and Estimates (PSE) package is approved. Ultimately, the final PSE should not obstruct the completion of the RW clearance, and the RW clearance should not delay the Final PSE. | |||

These instructions should be used as a map to identify where you are in the RW Process and what to do next. Like many maps, it will not tell you how long it takes, but simply how to get there. How long it will take is up to the project sponsor and the designer. Dealing with private property owners can be dynamic and complicated, but is not out of your control. The more time you can allow for this phase, the more likely you are to meet your schedule for construction. | |||

'''Square 1''' | |||

The RW Process actually begins during the Preliminary Design Plans (PDP) stage. The approvals you must obtain during PDP directly affect your ability to begin RW Acquisition. Check with your District Design Liaison (DDL) on the status of the environmental and historic clearances. Among other requirements, the environmental categorical exclusion approval must be obtained before the PDP can be approved. | |||

Some projects will receive a programmatic categorical exclusion for the environmental clearance and a CE-2 submittal will not be required. All projects will still require a [[127.2 Historic Preservation and Cultural Resources|Section 106 Historic]] clearance. A Section 106 form should be sent to the Missouri Department of Natural Resources (MoDNR) to be reviewed as soon as possible in order to keep the process moving. When the CE-2 has been received and the Section 106 has been applied for you may move to the next step. | |||

'''Square 2''' | |||

The PDP must be approved prior to submitting RW Plans for approval. This is because the FHWA intends to ensure the alignment will not change before participating in RW or Construction costs. When your Preliminary Design plans are approved, please move ahead. | |||

'''Squares 3 and 4''' | |||

Submit RW Plans to MoDOT for review, if there are comments made, revise them and move to the next square. If no comments are made and the RW Plans are approved, skip the next square and move directly to Square 5, RW Plans Approved. | |||

With no time to waste, move ahead to Square 6; review the most recent RW Cost Estimate for accuracy, age and any new developments with regard to property owners, land sales or new construction. Now is the time to update this cost estimate to ensure you have an accurate number. For a list of eligible and reimbursable RW costs, contact your MoDOT district RW office. Now move to the next square. | |||

'''Square 7''' | |||

Now that your reasonably sure how much it will cost, the LPA must determine who will acquire the RW and how it will be paid for. Either one has a direct effect on the other and will decide which path your local agency will take. | |||

'''Square 8A''' | |||

Local: If the LPA is staffed to acquire RW, AND the cost is within the local funds held by the LPA for this project, then it may be prudent to use the Local slide to skip the next two squares. Warning, all RW costs will be paid for by the LPA and ONLY the LPA will be accountable for adherence to the requirements of state laws and the CFR Titles 23 and 49, including the Uniform Act. | |||

'''Square 8B''' | |||

FHWA: If on the other hand, the local funding is insufficient for the RW Cost estimated, OR the agency is not staffed to acquire RW, it is strongly recommended the LPA use the FHWA path to hire a RW Agent or Firm from MoDOT’s approved list. | |||

'''Squares 9 and 10''' | |||

These may include appraisers, negotiators, lawyers, mediators or any firm, which handles all types of right of way services. This path also includes obligating federal funding for the eventual reimbursement of a large percentage of these RW Costs. The LPA and the RW Consultant will both be accountable for adherence to the requirements of state laws and the CFR Titles 23 and 49, including the Uniform Act. | |||

'''Square 11''' | |||

The Environmental CE-2 approval was obtained before PDP. Make a copy and hold it until Square 13. Move ahead one square. | |||

'''Square 12''' | |||

The Section 106 Historic Register approval / clearance should be available by this time. If you have approval letter, make a copy and hold until you move ahead one space. | |||

'''Square 13''' | |||

Fill out the [https://epg.modot.org/forms/general_files/DE/RW-LPA/Acquisition_Authority_Request(Form_136.8.1).docx Acquisition Authority Request (Form 136.8.1)]. If you have taken the path of FHWA, use the A-Date Request form to have MoDOT review and forward it to FHWA and obligate federal funds for RW Acquisition. Move ahead and wait. | |||

<div id="Square 14"></div> | |||

'''Square 14''' | |||

If you are following the path marked Local, complete the “Request for Right of Way Acquisition Authority (A-Date) Notice to Proceed” and check the box “Local Public Agency will fund all RW activities…”, your MoDOT - District office will grant your approval to begin RW Acquisition without the use of federal funds in RW. You will be notified when you may begin acquisition. If you check the box “Local Public Agency is requesting Federal Participation in funding RW activities, then you must wait for FHWA to obligate those federal funds. | |||

The only thing you should have done at this point with regard to RW Acquisition is title work, RW plans, cost estimates and complete the Right of Way Scheduling Tool. These are all eligible for reimbursement under Preliminary Engineering (PE). You may also send a letter to all affected property owners, to advise them of their rights according to the [https://revisor.mo.gov/main/OneSection.aspx?section=523 Eminent Domain Law, RsMO 523.000]. | |||

'''Square 15''' | |||

You will get an email, phone call or a letter telling you the federal funds are now approved, and you may begin the acquisition of RW and Easements for your project. You have just made it over hurdle number two. Congratulations, now it gets tougher. | |||

'''Squares 16A and 17A''' | |||

If your project is not complicated, you may want to request donation from the owners. Move to the next square. If the owners sign those donation documents, and deeds conveying the easements you need, make sure the owners also sign the waiver of compensation letter. This is a federal regulation to ensure they were informed of their rights to compensation for any type of acquisition on their property. Once you have all of them signed, move one square. | |||

'''Square 18A''' | |||

In either case, complicated or not, the deeds must be recorded. This can be costly so remember to plan for this expense when making the decision on whether to use federal funds or local funds for acquisition. Along the way, be sure to work on completing the final plans package (PSE) for construction. Do not advertise until allowed by MoDOT. | |||

'''Squares 16B, 17B and 18B''' | |||

If your project is complicated, you can begin to get property appraised, have those appraisals reviewed and move to the next square. Negotiate the offers and justify settlements, if necessary and move on. Then, for those owners with whom you cannot reach an agreement, you may want to consider Condemnation and the effects of acquiring the parcels thru Eminent domain. You have a right to do this, so use it if you must. After all, any project built on all of the easements and RW originally proposed, is a better project than one with less RW acquired. | |||

'''Square 19''' | |||

Submit your RW Clearance Certification to the District Design Liaison, or the Central Office RW Section staff designated to handle Federal-Aid projects. Please do this as early as possible to ensure there is time to review the acquisition files. Many times RW personnel will be available to come to your city or county to perform the review. In most cases, this may be more efficient; if there are any changes to be made, it typically can be handled on the spot. | |||

If your parcel files are not in order, you will spend whatever additional time it takes to remedy the situation in order to certify the RW is clear. This must be completed before any construction activity can take place. If the parcels have been acquired according to policies and procedures, MoDOT will advise you that your RW Clearance Certification is approved and ready to move the project along. | |||

'''Square 20''' | |||

Congratulations you have successfully completed the three steps involved in RW Acquisition; RW Plans, Acquisition Authority, and RW Clearance Certification. | |||

Should you have any questions, please refer to the remainder of this LPA-LAM or contact your MoDOT Federal-Aid Project representative. | |||

=136.8.2 Funding= | |||

==136.8.2.1 Funding Requirements== | |||

Right of way acquisition by public entities is governed by [https://revisor.mo.gov/main/OneSection.aspx?section=523 Revised Statutes of Missouri, (RSMo) 523]. To assure the protection of individuals' property rights affected by transportation projects, requirements of the [http://www.fhwa.dot.gov/realestate/ua/index.htm Uniform Act] must also be followed. | |||

Right of way costs for a project and incurred by the LPA may be the sole responsibility of that LPA or they may wish to have a share of these costs reimbursed by the FHWA through MoDOT. In either case, the LPA must first make a request to their MoDOT District personnel in order to receive approval to begin right of way and easement acquisition. Every effort should be made to ensure the right of way funds are obligated for a project before any eligible costs are incurred, if the LPA wishes to be reimbursed for those costs. If the LPA will fund the entire right of way expense, the approval to begin the acquisition must still be obtained. | |||

Federal funds participation in eligible right of way costs may become necessary after acquisition has begun. If acquisition activities have followed minimum requirements, approval for the federal participation can be expedited. The federal requirements reflect the appropriate acquisition activities for any land or property rights acquisition. | |||

If at any point in the acquisition process, federal funds are found to be necessary or desirable for right of way acquisition; an Acquisition Authority (A-date) must be obtained, as outlined in the next paragraph. Acquisition costs incurred prior to receipt of an A-date will not be eligible for federal funds participation. | |||

==136.8.2.2 Acquisition Authority== | |||

A Request for Acquisition Authority (A-date)/Notice to Proceed is an application to MoDOT, certifying approval of plans and environmental and archaeological classifications, execution of supplemental agreements (if any), adequate right of way staff or use of fee services, noting the use of LPA funds for right of way or requesting federal funds participation, and an estimate of the right of way acquisition cost. Activities such as appraisals, extending written offers, negotiations, etc., are not to begin until such time as MoDOT has notified the LPA that the acquisition authority has been granted. | |||

Right of Way staff will enter the A-date request date, upload ROW plans, and documents into the LPA SMS (State Management System Application). | |||

The LPA may request an A-date/Notice to Proceed by submitting: | |||

:* A completed [https://epg.modot.org/forms/general_files/DE/RW-LPA/Acquisition_Authority_Request(Form_136.8.1).docx A-Date Request (Form 136.8.1)] | |||

:* A set of completed and certified right of way plans | |||

:* Copies of the Section 106 Historic Clearance and Environmental Approvals | |||

:* A cost estimate indicating acquisition costs that are a reflection of the original agreement | |||

:* [https://epg.modot.org/forms/RW/LPA%20Links/Right%20of%20Way%20Acquisition%20Schedule%20Form%20136.8.2.2.docx Right of Way Acquisition Schedule (Form 136.8.2.2)] – see [https://epg.modot.org/forms/RW/LPA%20Links/Right%20of%20Way%20Acquisition%20Scehdule%20Instructions%20Form%20136.8.2.2.A.docx Right of Way Acquisition Schedule Instructions (Form 136.8.2.2.A)]. | |||

The A-Date Request Form 136.8.1 should be completed by the LPA and submitted to the local MoDOT district office. Assistance in filling out this form is available from MoDOT district personnel. | |||

If federal funds will participate in any part of the project (right of way or construction) right of way may not be acquired until the Federal Highway Administration (FHWA) has approved the environmental document, and Section 106 (Historic and archeological considerations) has been completed, as per [https://epg.modot.org/index.php?title=136.4_Environmental_and_Cultural_Requirements#136.4.1_National_Environmental_Policy_Act_.28NEPA.29_Classification EPG 136.4.1 National Environmental Policy Act (NEPA) Classification]. Failure to accomplish all environmental documentation prior to acquisition of right of way might jeopardize federal funds participation in the entire project. | |||

The acquiring agency is responsible for submitting evidence that environmental and cultural requirements have been addressed and approved. Verification of completion of these requirements is addressed through the MoDOT District Liaison Engineer, Design by submitting copies of the CE 2 and Section 106 approvals attached to the A-Date Request Form, Request for Acquisition Authority will document the completion of all environmental clearances on projects with or without federal funds participation in the right of way phase | |||

If fee services are necessary, use of a written contract is recommended. (Refer to [[#136.8.11 Right of Way Services Through Contract|EPG 136.8.11 Right of Way Services Through Contract]].) Fee appraisers utilized to prepare Value Finding or Standard Format Appraisals must be State Certified, either Residential or General, and be listed on MoDOT’s approved roster of fee appraisers. Non-certified individuals, familiar with real estate values may be used to prepare Waiver Valuations on projects. Fee negotiators also have their own MoDOT approved roster from which to select qualified acquisition service contractors. | |||

== | ==136.8.2.3 Notification by MoDOT== | ||

MoDOT will notify the local agency in writing to proceed with right of way activities after MoDOT has reviewed and approved the data provided by the LPA. If federal funds are to be used, the notification will include a revised summary of costs clearly indicating the right of way funds are set up. | |||

==136.8.2.4 Costs Eligible for Reimbursement Before Receipt of an A-Date== | |||

Costs in preliminary right of way activities (those prior to the appraisal phase such as preliminary right of way project cost estimates, title work and description writing) are eligible for federal participation as a preliminary engineering activity. These costs are eligible for reimbursement after prior approval by MoDOT through preliminary engineering. | |||

: | [http://marc.org/ Mid-America Regional Council (MARC)] does not allow reimbursement of Preliminary Engineering costs, because such costs are part of that agency's participation agreement. (This affects Jackson, Platte, Clay and Cass counties.) | ||

==136.8.2.5 Costs Eligible for Reimbursement After Receipt of an A-Date== | |||

:* Real property acquisition. | |||

:* | :* Incidental costs to the acquisition. (i.e. appraisal, appraisal review, negotiation, and relocation expense, recording documents, etc.) | ||

:* Pro rata taxes and/or special assessments. | |||

:* | :* Permanent and temporary easements. | ||

:* Damages to remainder of real property. | |||

:* Cost of acquisition through condemnation, interest on legal settlement or court awards, and court commissioner fees. | |||

:* Tenant-owned improvements. | |||

:* Uneconomic remnants. | |||

:* Construction in exchange for donation, or mitigation of damages. | |||

:* Relocation payments and expenses. | |||

==136.8.2.6 Support for Claims for Reimbursement== | |||

Support for claims for reimbursement shall include: | |||

'''1)''' A right of way map or plan showing the rights of way authorized, and actually acquired, including items indicated ([https://epg.modot.org/forms/RW/LPA%20Links/Plan%20Review%20Checklist%20Form%20136.8.18.docx RW Plan Review Checklist (Form 136.8.18)]). | |||

'''2)''' Statement of cost of right of way showing: | |||

:* parcel number | |||

:* cost of parcel | |||

LPAs must maintain an inventory of all improvements acquired; how these improvements are disposed of; an accounting of management expenses (i.e. advertising for disposal, preparing demolition contracts, etc.), rental receipts received, and recovery payments for disposition of improvements; and rodent control costs. See [[ | :* cost of excess land, if any | ||

:* credits by parcel or project | |||

:* incidental expenses by parcel or project | |||

:* cost of construction performed in mitigation of damages on a parcel basis if claimed as a right of way item. (Refer to [http://www.fhwa.dot.gov/realestate/lpaguide/app3.htm 23 CFR 710.203(a)(1)]). | |||

==136.8.2.7 Inspection of Documents== | |||

All documents relating to acquisition of the right of way shall be available for inspection at reasonable times by authorized representatives of MoDOT and Federal Highway Administration. Refer to [http://ecfr.gpoaccess.gov/cgi/t/text/text-idx?c=ecfr&rgn=div5&view=text&node=23:1.0.1.8.39&idno=23#23:1.0.1.8.39.2.1.1 23 CFR 710.201 (f)]. All documentation shall be kept a minimum of three years after the final invoice is submitted for the right of way costs. | |||

Right of Way staff are required to enter the Right of Way Approval Letter, The Right of Way Acquisition Date Letter, the Right of Way Clearance Letter, and any working Right of Way Documents into the LPA SMS (State Management System Application). | |||

==136.8.2.8 Federal Project Number== | |||

All plans, contracts, deeds, appraisals, options, vouchers, correspondence and all other documents and papers shall carry the Federal-aid project number for identification and be included in the LPA SMS application. | |||

=136.8.3 State Monitoring= | |||

MoDOT has overall responsibility for acquisition of right of way needed in connection with all federal funded projects, and MoDOT must assure compliance with federal regulations. This assurance is provided at the same time the agency certifies clearance of right of way and requests authority to advertise for physical construction. In order to give this assurance, MoDOT personnel will provide a resource for information on proper procedures, and may monitor the agency's acquisition activities during the acquisition process, and will monitor the entire project, or representative samples, prior to clearance certification. | |||

MoDOT will utilize Monitor Checklists ([https://epg.modot.org/forms/RW/LPA%20Links/Project%20Acquisition%20Monitor%20Checklist%20Form%20136.8.20.docx Form 136.8.20 for Project/Acquisition], [https://epg.modot.org/forms/RW/LPA%20Links/Appraisal%20Monitor%20Checklist%20Form%20136.8.4.docxnForm 136.8.4 for Appraisal] and [https://epg.modot.org/forms/RW/LPA%20Links/Relocation%20Monitor%20Checklist%20Form%20136.8.22.docx Form 136.8.22 for Relocation Assistance]), to evaluate the various activities. For small projects all parcels may be monitored. For larger projects, a sample may be utilized. | |||

The state's sole objective in this monitoring activity is to assure that when federal funds are requested by the agency in any phase of the project, that acquisition activity will have fulfilled all the requirements for the agency to receive such funds. Agencies are therefore requested to consult with the right of way manager, at the MoDOT district office, at any stage of the right of way function. MoDOT personnel can provide a technical resource, and assure that right of way acquisition is in compliance with regulations. Early consultation can eliminate problems and facilitate delivery of federal funds. | |||

=136.8.4 Retention and Access to Records= | |||

The acquiring agency shall maintain a project file (i.e. appraisal data book(s), title services contract, public hearing record, etc.) and a parcel file containing the information pertaining to the acquisition of the parcel. | |||

The parcel file should contain documentation that demonstrates compliance with applicable laws and requirements and should be available for inspection at reasonable times by authorized representatives of MoDOT and Federal Highway Administration and other authorized federal representatives. Refer to [http://ecfr.gpoaccess.gov/cgi/t/text/text-idx?c=ecfr&rgn=div5&view=text&node=23:1.0.1.8.39&idno=23#23:1.0.1.8.39.2.1.1 23 CFR 710.201 (f)]. The record retention period is three years and begins when the project closure action for the construction project is submitted to the Federal Highway Administration. | |||

LPAs must maintain an inventory of all improvements acquired; how these improvements are disposed of; an accounting of management expenses (i.e. advertising for disposal, preparing demolition contracts, etc.), rental receipts received, and recovery payments for disposition of improvements; and rodent control costs. See [[136.8 Local Public Agency Land Acquisition#136.8.12 Property Management|EPG 136.8.12 Property Management]] for additional requirements. | |||

'''NOTE''': LPAs are reminded that it is their responsibility to report payments to owners for real estate purchases to the Internal Revenue Service. Specific instructions on reporting requirements are found in the [[236.7 Negotiation#236.7.7 1099-S Reporting of Acquisitions|IRS instructions for 1099 Form]]. Certain penalties for not reporting may be encountered. | '''NOTE''': LPAs are reminded that it is their responsibility to report payments to owners for real estate purchases to the Internal Revenue Service. Specific instructions on reporting requirements are found in the [[236.7 Negotiation#236.7.7 1099-S Reporting of Acquisitions|IRS instructions for 1099 Form]]. Certain penalties for not reporting may be encountered. | ||

= | Right of Way staff are required to enter the Right of Way Approval Letter, The Right of Way Acquisition Date Letter, the Right of Way Clearance Letter, and any working Right of Way Documents into the LPA SMS (State Management System Application). | ||

=136.8.5 Plans and Title Information= | |||

== | ==136.8.5.1 Plans== | ||

Plans for a project must provide land or right of way adequate for the construction, operation and maintenance of the facility for the protection of both the project facility and the public. | Plans for a project must provide land or right of way adequate for the construction, operation and maintenance of the facility for the protection of both the project facility and the public. | ||

| Line 251: | Line 322: | ||

If the project is not for road purposes, plan requirements may be different, as imposed by agencies other than the Federal Highway Administration. Check with MoDOT’s district right of way manager for the plan requirements of those jobs. | If the project is not for road purposes, plan requirements may be different, as imposed by agencies other than the Federal Highway Administration. Check with MoDOT’s district right of way manager for the plan requirements of those jobs. | ||

Right of way plans are a supporting document for any progress or final claim for | Right of way plans are a supporting document for any progress or final claim for federal reimbursement of expenditures made for right of way when federal funds have been authorized in the right of way acquisition. Elements required on the plans for right of way purposes are indicated on the [https://epg.modot.org/forms/RW/LPA%20Links/Plan%20Review%20Checklist%20Form%20136.8.18.docx RW Plan Review Checklist (Form 136.8.18)]. | ||

: | |||

== | ==136.8.5.2 Title Information== | ||

Title and ownership information is needed for the purpose of establishing property lines, computing ownership areas, right of way areas, etc. Certain title information is necessary to determine if marketable title is passing to the acquiring agency. When minor rights of way and/or temporary rights are the only rights being acquired, it is permissible to determine ownership by use of the last deed of record. | Title and ownership information is needed for the purpose of establishing property lines, computing ownership areas, right of way areas, etc. Certain title information is necessary to determine if marketable title is passing to the acquiring agency. When minor rights of way and/or temporary rights are the only rights being acquired, it is permissible to determine ownership by use of the last deed of record. See [[236.4 Description Writing and Titles#236.4.4.1 Purpose|EPG 236.4.4.1 Purpose]] for more information regarding property ownership determination. | ||

When acquiring realty rights, verification that the correct entity has executed the conveyance document is important. Refer to [https://epg.modot.org/forms/RW/Chapter%207_Negotiation/MoDOT%20Verification%20of%20Signatory%20on%20Conveyance%20Documents.pdf MoDOT Verification of Signatory on Conveyance Documents] for guidance. | |||

If necessary, commitments for title insurance may be obtained from qualified title agencies. | Title information needed is owner's name, total area of contiguous lands comprising the ownership, information regarding mortgages, special assessments, liens, taxes, etc., to enable the LPA staff to prepare the necessary documents for title transfer. Required title information may be secured by a qualified member of the LPA staff or purchased from a title company doing business in the county. If necessary, commitments for title insurance may be obtained from qualified title agencies. | ||

Alternatively, the LPA can obtain abstracts from which the agency's attorneys can determine the conditions of titles. Each abstract will cover a minimum period of 30 years or no less than four conveyances, except where it reasonably appears that an indicated ownership of the fee title of more than 30 years duration exists. Abstracts should also include conveyances of easements, mineral rights, or other interests of less than fee title, which appear of record. | Alternatively, the LPA can obtain abstracts from which the agency's attorneys can determine the conditions of titles. Each abstract will cover a minimum period of 30 years or no less than four conveyances, except where it reasonably appears that an indicated ownership of the fee title of more than 30 years duration exists. Abstracts should also include conveyances of easements, mineral rights, or other interests of less than fee title, which appear of record. | ||

The cost of obtaining the necessary title information is an incidental cost to right of way acquisition, and is one of the costs that are eligible for | The cost of obtaining the necessary title information is an incidental cost to right of way acquisition, and is one of the costs that are eligible for federal participation. Preliminary title work, like last deeds of record and title commitments, is a preliminary engineering cost, and eligible for participation if only construction is federal participating. Title insurance, and later title opinions are generally considered a right of way expense, and are only receive federal participation if there are federal funds in the right of way acquisition portion of a project. | ||

When non-complex property or property rights are donated, a proper LPA authority may waive acquisition of additional property interests (like partial mortgage releases, easement owners, tenant interests, etc.), but a memo outlining the waiver to acquire additional property interests should be included in the file. | When non-complex property or property rights are donated, a proper LPA authority may waive acquisition of additional property interests (like partial mortgage releases, easement owners, tenant interests, etc.), but a memo outlining the waiver to acquire additional property interests should be included in the file. | ||

== | =136.8.6 Appraisal and Appraisal Review= | ||

==136.8.6.1 Definition of Appraisal and Waiver Valuation== | |||

The acquiring agency must offer the property owner an amount that it believes to be just compensation, and that amount is to be based on the fair market value of the property as determined by a professionally prepared, reviewed and approved appraisal or waiver valuation. Further, the Uniform Act provides that the amount of just compensation shall be no less than the amount of the agency's approved appraisal or waiver valuation. | |||

'''Appraisal:''' An appraisal is defined in the Uniform Act as: A written statement independently and impartially prepared by a qualified appraiser setting forth an opinion of defined value of an adequately described property as of a specific date, supported by the presentation and analysis of relevant market information. See [http://ecfr.gpoaccess.gov/cgi/t/text/text-idx?c=ecfr&sid=3bdda26e1102fe42dd21611091c4a569&rgn=div5&view=text&node=49:1.0.1.1.18&idno=49#49:1.0.1.1.18.1.16.2 49 CFR 24.2 (a) 3]. | |||

'''Waiver Valuation:''' An appraisal waiver is not an appraisal as defined by the Uniform Act. See [http://ecfr.gpoaccess.gov/cgi/t/text/text-idx?c=ecfr&sid=3bdda26e1102fe42dd21611091c4a569&rgn=div5&view=text&node=49:1.0.1.1.18&idno=49#49:1.0.1.1.18.2.16.2 49 CFR 24 102 (c)]. The purpose of the appraisal waiver provision is to provide a technique to avoid the costs and time delay associated with appraisal requirements for low-value, non-complex acquisitions. The intent is that non-appraisers and appraisers in training may make waiver valuations. | |||

Use of the Waiver Valuation is allowed when: | |||

:* the acquisition is simple and $25,000 or less, plus fence re-establishment costs | |||

:* land value is easily determined, | |||

:* only nominal structural improvements are acquired, | |||

:* only nominal access rights are acquired | |||

Acquisition of real property and property | :* other than fence, costs to cure cannot make the total compensation exceed $25,000 | ||

:* there are no apparent damages to the remainder – other than simple easements and creation of nominal uneconomic remnants. | |||

===136.8.6.1.1 Appraisal Formats and Instructions=== | |||

MoDOT makes appraisal formats and waiver valuation formats and their instructions available for Local Public Agency use. Use of these forms and instructions will fulfill the LPA’s obligation to obtain a valuation for each acquisition. The LPA is provided access to these instructions and forms with the following links. The valuation instructions and formats are applicable for all users. | |||

'''Guidance''' | |||

:[[#136.8.6.3.1 Standard Appraisal Format|EPG 136.8.6.3.1 Standard Appraisal Format Instructions]] | |||

:[[#136.8.6.3.2 Value Finding Appraisal Format|EPG 136.8.6.3.2 Value Finding Appraisal Format Instructions]] | |||

:[[#136.8.6.3.3 Waiver Valuation|EPG 136.8.6.3.3 Waiver Valuation]] | |||

:[[#136.8.6.3.4 Uniform Residential Appraisal Report (URAR) and Addendum Instructions|EPG 136.8.6.3.4 Uniform Residential Appraisal Report (URAR) and Addendum Instructions]] | |||

:[[#136.8.6.3.5 Instructions for Preparing Sale Forms|EPG 136.8.6.3.5 Instructions for Preparing Sale Forms]] | |||

:[[#136.8.6.3.6 Access Rights Valuation|EPG 136.8.6.3.6 Access Rights Valuation]] | |||

:[[#136.8.6.3.7 Other Agency Valuations|EPG 136.8.6.3.7 Other Agency Valuations]] | |||

:[[#136.8.6.3.8 Airport Valuation|EPG 136.8.6.3.8 Airport Valuation]] | |||

'''Forms''' | |||

:[https://epg.modot.org/forms/general_files/DE/RW-LPA/Standard_Appraisal_Form_136.8.29.docx Standard Appraisal Format] | |||

:[https://epg.modot.org/forms/RW/LPA%20Links/Assumptions%20and%20Limiting%20Conditions%20Form%20136.8.6.docx 136.8.6 Assumptions and Limiting Conditions] | |||

:[https://epg.modot.org/forms/RW/LPA%20Links/Certificate%20of%20Appraiser%20Form%20136.8.7.docx 136.8.7 Certificate of Appraiser] | |||

:[https://epg.modot.org/forms/RW/LPA%20Links/Summary%20Value%20of%20Tenant%20Interests%20Form%20136.8.31.docx 136.8.31 Tenant Summary] | |||

:[https://epg.modot.org/forms/general_files/DE/RW-LPA/Value_Finding_Appraisal_Format_136.8.33.docx Value Finding Appraisal Format] | |||

:[https://epg.modot.org/forms/general_files/DE/RW-LPA/Waiver_Valuation_Payment_Estimate_Form_136.8.34.docx 136.8.34 Waiver Valuation – Payment Estimate] | |||

:[https://epg.modot.org/forms/general_files/DE/RW-LPA/Uniform_Residential_Appraisal_Format_(URAR)_Form_136.8.32.docx 136.8.32 URAR and Addendum] | |||

:[https://epg.modot.org/forms/RW/LPA%20Links/Nonresidential%20Sale%20Form%20136.8.16.docx 136.8.16 Nonresidential Sale] | |||

:[https://epg.modot.org/forms/RW/LPA%20Links/Residential%20Sale%20Form%20136.8.23.docx 136.8.23 Residential Sale] | |||

:[https://epg.modot.org/forms/RW/LPA%20Links/Comparable%20Lease%20Form%20136.8.9.docx 136.8.9 Comparable Lease] | |||

===136.8.6.1.2 Scope of Assignment=== | |||

[http://ecfr.gpoaccess.gov/cgi/t/text/text-idx?c=ecfr&sid=3bdda26e1102fe42dd21611091c4a569&rgn=div5&view=text&node=49:1.0.1.1.18&idno=49#49:1.0.1.1.18.2.16.3 49 CFR 24.103(s)] requires minimum standards for appraisals consistent with established appraisal practice. [http://uspap.org Uniform Standards of Professional Appraisal Practice (USPAP)], (also see [[#136.8.6.3.1.17 Uneconomic Remnant|EPG 136.8.6.3.1.17 Uneconomic Remnant]]), contains a “Scope of Work Rule”, which requires identification of the problem to be solved, determination and performance of the scope of work necessary to develop credible assignment results, and disclosure of the scope of work in the report. To fulfill the objectives of the CFR and USPAP, MoDOT has developed the Scope of Assignment process to assure appraisal reports meet reporting requirements and provide a high quality appraisal document. The Scope of Assignment preparer must be familiar with the requirements of the various formats (see [[#136.8.6.3 Valuation Formats and Instructions|EPG 136.8.6.3]]). | |||

LPAs may refer to [[#Scope_of_Assignment_Process Scope of Assignment Process]] and [https://epg.modot.org/forms/RW/LPA%20Links/Scope%20of%20Assignment%20Form%20136.8.28.docx Form 136.8.28]. | |||

[http://ecfr.gpoaccess.gov/cgi/t/text/text-idx?c=ecfr&sid=3bdda26e1102fe42dd21611091c4a569&rgn=div5&view=text&node=49:1.0.1.1.18&idno=49#49:1.0.1.1.18.2.16.4 49 CFR 24.104] requires a review process, and minimum standards thereof. USPAP also contains standards for appraisal review. To fulfill the objectives of the CFR and USPAP, MoDOT has developed the a review process and forms. Refer to [[#136.8.6.4 LPA Appraisal Review and Approval of Just Compensation|EPG 136.8.6.4 LPA Appraisal Review and Approval of Just Compensation]] and Forms [https://epg.modot.org/forms/general_files/DE/RW-LPA/Appraisal_Review_and_Approval_of_Just_Compensation_Form_136.8.5.docx 136.8.5 Appraisal Review] and [https://epg.modot.org/forms/RW/LPA%20Links/Adj%20of%20Value%20or%20Just%20Compensation%20Form%20136.8.2.docx 136.8.2 Adjustment of Value]. The review appraiser must be familiar with the requirements of the various formats (see [[#136.8.6.3 Valuation Formats and Instructions|EPG 136.8.6.3 Valuation Formats and Instructions]]). | |||

'''Staff and Fee Appraiser Activity and Personnel Approval by MoDOT''' | |||

'''A. Staff Appraiser''' | |||

Staff Appraisers who will prepare Value Finding and Standard format appraisals must carry adequate qualifications to accomplish the appraisal assignment, and be approved by MoDOT District Right of Way Managers. | |||

MoDOT and this article impose no requirement on the staff of LPAs. However, it is recommended that agencies subscribe to the MoDOT requirement for staff appraisers, which is: | |||

Staff appraisers are generally expected to exhibit knowledge of business and real estate as might be acquired through graduation from an accredited four year college or university with a bachelor degree in real estate, finance, economics, business administration, public administration, or related area. | |||

Two years experience with the LPA in right of way activities, or four years' experience outside the LPA in a comparable position. | |||

Completion of training courses in real estate, appraisal principles and appraisal procedures. | |||

<div id="B. Fee Appraisers Must Be On Roster Of Approved Contract Appraisers"></div> | |||

'''B. Fee Appraisers Must Be On Roster Of Approved Contract Appraisers''' | |||

The selection of fee appraisers should be based upon the qualification level and experience necessary for the type of appraisals to be encountered. The selected appraiser must appear on the [https://epg.modot.org/index.php?title=236.6_Appraisal_and_Appraisal_Review#236.6.5.4_Roster_of_Approved_Contract_Appraisers Roster of Approved Contract Appraisers]. The roster also indicates those appraisers that have been pre-qualified for appraisal review. | |||

:''' Duration of Approval of Fee Appraisers on the Roster of Approved Appraisers/Reviewers''' | |||

:Duration of approval on the Roster of Approved Fee Appraiser/Reviewers is 3 years. A renewal application will be sent to each fee appraiser/reviewer 2 months prior to their 3 year expiration date as contained in MoDOT’s database. The renewal application will seek to determine the applicants desire to remain on the list and also to capture updated information including address, phone numbers, email addresses and areas of the state the applicant is interested in performing work. Renewal dates are contained in the Roster of Approved Appraisers. If you have any questions, contact the Right of Way Section of MoDOT's Design Division. | |||

'''C. Separation of Functions - Appraisal/Review/Negotiation''' | |||

Negotiations shall be conducted by someone other than the appraiser or reviewing appraiser of the real property to be acquired, except that the acquiring agency may permit the same person to value and negotiate an acquisition where the value is $25,000 or less. However, the valuation must be reviewed and an amount approved by another designated agency official before the initiation of negotiations. | |||

Appraisals prepared by agency staff may not be reviewed by the appraiser that made the appraisal. Appraisals prepared by contract appraisers may not be reviewed by a member of the same firm as the appraiser | |||

===136.8.6.1.3 Staff and Fee Appraisal Review Activity and Personnel Approval by MoDOT=== | |||

'''A. Approval and Co-signing of Waiver Valuation - Payment Estimates''' | |||

Agency officials familiar with real estate values can inspect and co-sign or approve compensation determined on a [[#136.8.6.3.3 Waiver Valuation|Waiver Valuation]]. | |||

'''B. Review and Approval of Value Finding or Standard Format Appraisals''' | |||

Qualified review appraisers are necessary to approve Just Compensation estimated by appraisers on the Value Finding or Standard Format appraisals. Staff reviewers who will approve just compensation based on staff appraisals by Value Finding and Standard formats, must be approved by MoDOT. Fee review appraisers must be on the [https://epg.modot.org/index.php?title=236.6_Appraisal_and_Appraisal_Review#236.6.5.4_Roster_of_Approved_Contract_Appraisers Roster of Approved Contract Appraisers] and pre-qualified as review appraisers on the roster. | |||

==136.8.6.2 Scope of Assignment== | |||

49 CFR 24.103 (s) requires minimum standards for appraisals consistent with established and commonly accepted appraisal practice, including all relevant and reliable approaches to value. These appraisal requirements accommodate an appraisal reporting level commensurate with complexity. [[#136.8.6.3.1.20D.17 Uniform Standards of Professional Appraisal Practice|Uniform Standards of Professional Appraisal Practice (USPAP)]] contains a Scope of Work Rule, which requires identification of the problem to be solved, determination and performance of the scope of work necessary to develop credible assignment results, and disclosure of the scope of work in the report. To fulfill the objectives of the CFR and USPAP, the agency has developed the Scope of Assignment process to assure appraisal reports meet reporting requirements, appraisal principles and standards, and provide a high quality appraisal document. The Scope of Assignment preparer must be familiar with the requirements of the various formats, set out in [[#136.8.6.3 Valuation Formats and Instructions|EPG 136.8.6.3 Valuation Formats and Instructions]]. | |||

All Scope of Assignment documents will be prepared by an individual familiar with all appraisal requirements for proper appraisal practice, approaches to value, rules and laws relevant to valuation for condemnation purposes, 49 CFR, USPAP, etc. The scope will identify the anticipated minimum requirements for an appraisal document to address all issues resulting from acquisition from a property. The Scope of Assignment preparer shall assign a level of documentation consistent with the complexity and anticipated value conclusion range of each acquisition. The assignment criteria must assure adequate documentation yet not assign or pay for more work than meets the agency’s needs. | |||

The Scope of Assignment is a working document throughout the life of the appraisal work for a project, and only finalized when all assignments are complete. | |||

The completed Scope of Assignment, whether a parcel listing of format assignments, an in-depth Scope for each parcel, or a combination of both are to be dated and signed by the person who prepared the study. | |||

===Scope of Assignment Process=== | |||

Two Scope of Assignment processes are available. A Scope of Assignment may merely direct an appraiser experienced with MoDOT formats and their instructions, what format to use along with any special instructions. Otherwise, a more detailed Scope of Assignment shall be used for staff or fee appraisers less experienced with MoDOT formats, when fee appraisers will be competitively bidding, or when the appraisal assignment is so complex as to necessitate an in-depth Scope of Assignment. | |||

'''A. Scope of Assignment for Simple Assignment or Experienced Staff and Fee Appraisers''' | |||

MoDOT has established detailed instructions and formats that fulfill its and the agency’s appraisal needs. Through training and repetitive similar work assignments, staff and fee appraisers become familiar with the detailed instructions and their associated formats. Therefore, for experienced staff and fee appraisers, the Scope of Assignment preparer may merely reference the format required and any other special instructions or approaches to value. Even this abbreviated Scope of Assignment will follow the principles of a Scope of Assignment as set out for inexperienced staff or fee, below. | |||

'''B. Comprehensive Scope of Assignment for Complex Assignment or Inexperienced Staff and Fee Appraisers''' | |||

A comprehensive Scope of Assignment shall indicate the following for each parcel, when applicable: | |||

:1. Total land area, proposed acquisition area, temporary and permanent easement, etc. | |||

:2. A brief but comprehensive description of land and improvements. | |||

:3. The manner in which proposed highway improvement may affect remaining real property. | |||

:4. Identify and explain all observed elements of loss or damage. | |||

:5. Identify curable losses, if any are observed. | |||

:6. Under all appraisal formats the value estimates must include all fee owned and tenant owned improvements, both affected and unaffected. The scope may authorize the appraiser to estimate the contributory value of unaffected improvements. | |||

:7. A statement from the agency’s counsel with regard to special benefits when it is anticipated that such benefits may accrue to a remaining fee hold. | |||

:8. An in-depth explanation of those appraisal problems that warrant two appraisals on the same parcel. | |||

:9. A comprehensive Scope of Assignment shall indicate what evidence is required to support depreciation rates for affected improvements when a cost approach is specified. If primary reliance is likely to be placed on the cost approach a higher standard of support for the depreciation estimate should be required. | |||

:10. A comprehensive Scope of Assignment shall indicate if specialty appraisals to evaluate affected machinery, specialty items, trade fixtures, etc. are required. Also, if the agency or the fee appraiser is responsible for obtaining said appraisal and which party is responsible for the cost of specialty appraisals. | |||

:11. A comprehensive Scope of Assignment shall indicate a suggestion or requirement to engage a contractor to furnish cost to cure estimates for rehabilitating remainder buildings, correcting or revising affected sewer systems, water lines, fence, etc., and if the agency or the fee appraiser is responsible for obtaining and the cost of the contractor’s services. | |||

:12. Approaches to Value. The sales comparison approach often develops the most credible indication of value. In most situations this may be the only approach necessary to estimate just compensation. The cost less depreciation approach is best applied to newer, special use, or unique improvements not normally transferring in the market place. An income approach may be implemented when appropriate. | |||

:The Scope of Assignment shall indicate the recommended approach or approaches to value "before" as well as "after" when applicable. | |||

:The sales comparison approach shall be shown for parcels where appraiser relies upon vacant land sales and may estimate contributory value of unaffected improvements. | |||

==136.8.6.3 Valuation Formats and Instructions== | |||

===136.8.6.3.1 Standard Appraisal Format=== | |||

Use of the [https://epg.modot.org/forms/general_files/DE/RW-LPA/Standard_Appraisal_Form_136.8.29.docx Standard Appraisal Format] is required when: | |||

:* the appraisal problems are judged complex | |||

:* the highest and best use of a property as improved is different than the highest and best use as if vacant | |||

:* residential or other major improvements are acquired, unless use of the URAR appraisal is specified. | |||

:* there is a change in the highest and best use after the acquisition. | |||

The appraiser shall adhere to the following format and shall include paragraph headings and numbers as shown. The appraisal shall be typewritten on 8 1/2" x 11" paper with the pages numbered sequentially. | |||

These format instructions set out appraisal requirements of the agency, MoDOT and the Federal Highway Administration (FHWA). It is inevitable that appraisers will occasionally encounter situations that are not specifically addressed herein. In all cases the appraiser is responsible for a credible, adequately documented appraisal. Reasonableness and typical professional appraisal practices are the standard. | |||

There are a number of ownership items and appraisal problems frequently encountered in valuing acquisitions for transportation purposes, on which policies have been established by case law, management decision and precedent. These policies apply to all appraisal formats and are set out in [[#136.8.6.3.1.20D Other Appraisal Considerations|EPG 136.8.6.3.1.20D Other Appraisal Considerations]]. | |||

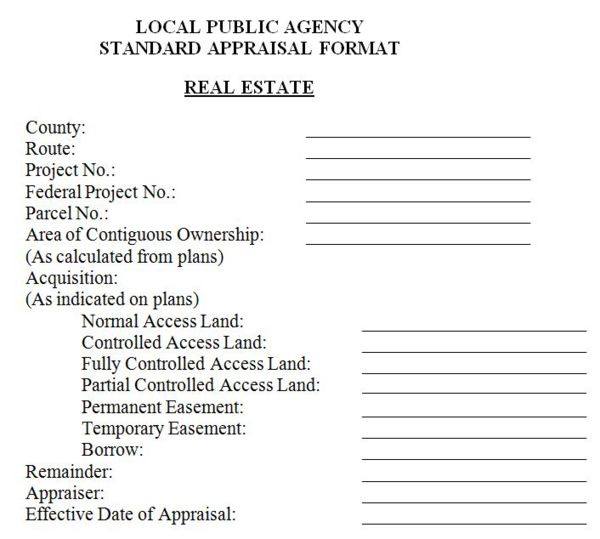

The following standardized identification block shall be included at the front of the appraisal, without deviation. | |||

[[image:236.18.6.3.1.jpg|center|600px]] | |||

Reporting the effective date of appraisal and date of report are required by CFR and USPAP. The effective date of appraisal establishes the context for the value opinion, generally the date of last inspection. For condemnation appraisal reports, the effective date will be the date the commissioners’ award is paid into court. The report date with the signature on the certificate should normally be the date the appraisal is complete or turned in for review. | |||

====136.8.6.3.1.1 Owner and Tenant Owner==== | |||

Identify owner and tenant owner by address, phone number, cell phone number, email address, etc. | |||

====136.8.6.3.1.2 Purpose of Appraisal==== | |||

The purpose of this appraisal is to estimate just compensation due the owners as a result of acquiring land and realty rights as herein described. | |||

'''Fair Market Value Definition:''' Fair market value is the value of the property taken after considering comparable sales in the area, capitalization of income, and replacement cost less depreciation, singularly or in combination, as appropriate, and additionally considering the value of the property based upon its highest and best use, using generally accepted appraisal practices. If less than the entire property is taken, fair market value shall mean the difference between the fair market value of the entire property immediately prior to the acquisition and the fair market value of the remaining or burdened property immediately after the acquisition. See [https://revisor.mo.gov/main/OneSection.aspx?section=523.001 RSMo 523.001]. | |||

Do not use definitions from various appraisal organizations and sources. Failure to use the above definitions can result in having the testimony of a witness stricken. | |||

'''Intended Use:''' The intended use of the appraisal report is to assist the agency in establishing the amount of compensation to pay for the land and property rights to be acquired. | |||

'''Intended Users:''' Intended users of this report are the agency (the client), the MoDOT, the FHWA and the United States Department of Transportation and persons authorized by the client. RSMo 523.253 requires a copy of this appraisal report be provided to the owner of the subject property for information only, the owner is not an intended user as defined by USPAP. | |||

'''Uniform Standards of Professional Appraisal Practice:''' The appraiser shall include in the appraisal report the following statement. See [[#136.8.6.3.1.20D.17 Uniform Standards of Professional Appraisal Practice|Uniform Standards of Professional Appraisal Practice]] for the background for this statement. | |||

'''USPAP Compliance Statement:''' This appraisal was prepared according to the contract/assignment from the agency. The intended use of the appraisal is for eminent domain related acquisition and the agency is the only intended user (except as indicated above). The agency bears responsibility for contract/assignment requirements that meet its needs and therefore are not misleading. In combination with the Scope of Assignment and review function, all appraisal reports assigned by the agency identify the problem to be solved, determine the scope of work necessary to solve the problem and correctly complete research and analysis necessary to produce a credible appraisal and are therefore in compliance with USPAP Standard 1. In that the agency is an intended user of the report and others may be provided copies for informational purposes, the agency has determined that reports prepared in conformance with these procedures constitute a Summary Appraisal Report which fulfills the agency’s needs. It is misleading for an appraiser to disregard a part or parts of USPAP as void and of no force and effect in a particular assignment without identifying in the appraiser’s report the part or parts disregarded and the legal authority justifying this action. | |||

====136.8.6.3.1.3 Interest Appraised==== | |||

The interest appraised will normally be fee simple interest. If the ownership is encumbered with a lease, the value conclusion may be a leased fee estate. Easement encumbrances impacting market value shall be identified. | |||

====136.8.6.3.1.4 Scope of Work==== | |||

Reference the information researched and the analysis applied in an assignment. Appraisers have a responsibility in determining the appropriate scope of work for an appraisal assignment. Credible assignment results require support by relevant evidence and logic. | |||

Scope of Work includes, but is not limited to: | |||

:* The extent to which the property and comparable sales were inspected | |||

:* The extent of data research | |||

:* The extent of analysis applied to arrive at opinions or conclusions. | |||

The Scope of Work is supplemented by the [https://epg.modot.org/forms/RW/LPA%20Links/Scope%20of%20Assignment%20Form%20136.8.28.docx Scope of Assignment, Form 136.8.28], a document prepared by individuals other than the appraiser, and setting out the minimum reporting requirements of the appraisal. | |||

====136.8.6.3.1.5 Identification of the Property==== | |||

The real estate involved in the appraisal can be specified by a property description, address, map reference, copy of a survey or map, property sketch and/or photographs or the similar information. Lengthy property descriptions should not be reiterated within the report, but rather copies of the title report or last deed of record should be reviewed by the appraiser and retained in the appraiser’s work file. | |||

====136.8.6.3.1.6 History of the Property==== | |||

The appraisal report must state the history of the property and cannot merely say, “No transfers” or “none.” Indicate all transfers of subject realty for the five years immediately preceding the date of the appraisal. Show the parties to the transactions, dates of transactions, books and pages, instrument numbers and verified sale prices when possible to obtain. If sales of the subject are comparable sales in the report, reference to them will satisfy the requirement of this article. Include details of any current sale agreement, option or listing of the subject property if such information is available to the appraiser in the normal course of business. If the information cannot be determined, the report should state the reasons. If the report states there has been no sale, contract, option, or listing, it must also state how that determination was made. | |||

Good appraisal practice dictates that appraisers consider and analyze recent sales, contracts, options or listings of the property being appraised. If, in the appraiser’s opinion, any of the above does not reflect current value of the property, the appraiser must provide reason. The phrase “not an arms length transaction” is not adequate without explanation. | |||

====136.8.6.3.1.7 Description of Property Before Acquisition==== | |||

=====136.8.6.3.1.7A Zoning===== | |||

The applicable code and category of zoning should be stated (for example, R-1 [the code], Single-Family District [the category]). Special zoning provisions or restrictions should be noted, such as minimum lot size or number of developed units allowed. The report should state whether the subject property is in conformance with the zoning code. | |||

If the subject is non-conforming, the highest and best use and value analysis sections of the report must deal with any effect of the non-conformity upon use and value. Probability of zoning change should be addressed in the highest and best use analysis. | |||

:* Code | |||

:* Category | |||

:* Compliance | |||

:* None | |||

=====136.8.6.3.1.7B Land===== | |||

Site description should include dimensions, shape, size and frontage as appropriate. Describe the topography, roads or streets and frontages, legal access rights and physical entrances, and all non-structural site improvements including but not limited to paving, curbing, retaining walls, landscaping, ponds and terracing. | |||

If agricultural land, information on soil types and productivity, percent cleared and timbered, and historic uses such as cropland and pasture land may be appropriate. | |||

Information should be included on encumbrances, recorded or unrecorded, such as deed restrictions, limitation of access, utility easements, flowage or drainage easements, etc. which may affect market value. | |||

:* Access Before Acquisition: | |||

The report shall discuss the available legal and physical access of the subject property as well as the comparable sales. Legal access represents a deeded or permitted access point to a property. Physical access merely reflects the presence of existing entrances, which may or may not be legal. | |||

:* Utilities In Use Before Acquisition: | |||

:* Utilities Available Before Acquisition: | |||

Identify what utilities are in use, whether public or private, and what utilities are reasonably available to the property. | |||

=====136.8.6.3.1.7C Fee Owned Improvements, Fixtures and Personalty===== | |||

These items shall be inspected, identified and described in sufficient detail to indicate their uses, quality, condition and location upon the premises. | |||

The description of affected improvements shall include such items as significant deferred maintenance, recent renovation and a statement of actual and effective age. | |||

Unaffected improvements shall be inspected to the extent that they can be adequately described. If directed in the Scope of Assignment, the appraiser may estimate the contributory value of unaffected improvements without support. | |||

The appraiser shall identify and value personal property, trade fixtures, or intangible items that are not real property but are impacted by the acquisition and are included in the valuation. When there are items such as appliances, fireplace inserts, equipment, on-premise signs, mobile homes, etc., which could be realty or personalty, the report shall identify them and state whether they are considered personalty or realty. See [[#136.8.6.3.1.20D.12 Personalty and Fixtures|EPG 136.8.6.3.1.20D.12 Personalty and Fixtures]] for instructions on personalty and fixtures. | |||